Gastric sleeve cost: Complete 2025 guide

When considering weight loss solutions, gastric sleeve surgery often emerges as a viable option for those struggling with severe obesity. While the procedure’s effectiveness is well-documented, understanding the financial aspects represents a crucial part of the decision-making process.

Whether you’re just beginning to explore bariatric surgery options or are actively planning for a gastric sleeve procedure, this comprehensive guide breaks down everything you need to know about gastric sleeve costs in 2025, from insurance coverage to financing alternatives.

What is gastric sleeve surgery?

Gastric sleeve surgery, medically known as sleeve gastrectomy, is a weight loss procedure that permanently reduces your stomach size. During the operation, a surgeon removes approximately 80% of your stomach, leaving behind a smaller, sleeve-shaped stomach pouch that limits the amount of food you can consume at one time.

This streamlined procedure has gained popularity because it doesn’t involve rerouting the intestines like some other bariatric surgeries. The resulting smaller stomach not only restricts food intake but also reduces hunger hormones called ghrelin, often leading to decreased appetite and sustainable weight loss.

How gastric sleeve works for weight loss

The gastric sleeve promotes weight loss through two primary mechanisms:

- Food restriction: With a significantly smaller stomach capacity (typically reduced from about the size of a football to the size of a banana), you’ll feel full after eating much smaller portions.

- Hormonal changes: The removal of a large portion of the stomach reduces production of hunger-stimulating hormones, potentially decreasing your desire to eat.

Most patients lose between 60-70% of their excess weight within the first year following surgery, with continued success when they adhere to dietary and lifestyle recommendations.

The true cost of gastric sleeve surgery in 2025

The cost of gastric sleeve surgery varies significantly depending on numerous factors. When budgeting for this procedure, it’s essential to understand both the direct costs and potential additional expenses.

Average cost breakdown

In 2025, the national average cost for gastric sleeve surgery in the United States typically ranges from $14,500 to $25,000. This price range reflects several components:

- Surgeon’s fees

- Anesthesia fees

- Hospital or surgical facility fees

- Pre-operative consultations and testing

- Post-operative care

- Follow-up appointments

For a clearer picture, here’s a breakdown of what you might expect to pay:

Surgical costs: $10,000-$18,000

Pre-surgery consultations and tests: $1,500-$3,000

Post-operative care: $3,000-$4,000

Geographic cost variations

Where you live significantly impacts the cost of gastric sleeve surgery. Major metropolitan areas and regions with a higher cost of living typically charge more for medical procedures. For example:

- Northeast region (NY, NJ, MA): $17,000-$25,000

- West Coast (CA, WA, OR): $16,000-$24,000

- Midwest states: $14,000-$20,000

- Southern states: $13,500-$19,000

According to a recent survey by the American Society for Metabolic and Bariatric Surgery, New York City, San Francisco, and Boston consistently rank among the most expensive locations for bariatric procedures, while cities in Texas, Florida, and Arizona often offer more affordable options.

Hidden costs to consider

Beyond the surgery itself, patients should budget for several other expenses:

- Time off work: Recovery typically requires 2-4 weeks away from work

- Special dietary requirements: Liquid and soft food diets during recovery

- Nutritional supplements: Lifelong vitamins and minerals (approximately $50-100 monthly)

- New clothing: As you lose weight, you’ll need to replace your wardrobe several times

- Body contouring surgery: Some patients later opt for skin removal procedures, which can cost $8,000-$20,000 if not covered by insurance

Insurance coverage for gastric sleeve surgery

Many people are surprised to learn that health insurance often covers gastric sleeve surgery for qualified candidates. However, navigating insurance requirements can be challenging.

Insurance requirements

Most insurance providers follow similar criteria for bariatric surgery coverage, typically requiring:

- BMI of 40 or higher (severe obesity) OR

- BMI of 35-39.9 with at least one obesity-related condition like type 2 diabetes, high blood pressure, or sleep apnea

- Documented history of failed weight loss attempts

- Psychological evaluation

- Participation in a medically supervised weight loss program (usually 3-6 months)

- Nutritional counseling

Coverage by insurance type

Different insurance plans offer varying levels of coverage:

- Private insurance: Many private insurance companies now include bariatric surgery in their benefits, though coverage varies widely by provider and specific plan. Companies like Aetna, Blue Cross Blue Shield, Cigna, and United Healthcare often cover gastric sleeve surgery with proper documentation and pre-authorization.

- Medicare: Medicare covers gastric sleeve surgery when you meet their requirements, which include having a BMI of 35 or higher with at least one obesity-related health condition and documentation showing that other weight loss methods have been unsuccessful.

- Medicaid: Medicaid coverage varies by state. While some states provide comprehensive coverage for bariatric surgery, others offer limited coverage or none at all. According to a 2024 report by the Obesity Action Coalition, 46 states currently provide some form of Medicaid coverage for bariatric surgery.

Out-of-pocket costs with insurance

Even with insurance coverage, patients typically face some expenses:

- Deductibles: Usually between $1,500-$5,000 depending on your plan

- Coinsurance: Typically 10-30% of the procedure cost

- Copayments: For pre-operative visits and follow-up care

- Non-covered services: Some insurance plans won’t cover certain aspects of care

According to research from the Healthcare Cost and Utilization Project, the average out-of-pocket cost for patients with insurance ranges from $3,500 to $7,000 for the entire treatment process.

Paying for gastric sleeve without insurance

If your insurance doesn’t cover gastric sleeve surgery or you’re uninsured, several payment options exist to make the procedure more accessible.

Self-pay discounts

Many bariatric surgery centers offer significant discounts for self-pay patients, sometimes reducing costs by 15-30%. These packages often include:

- The surgical procedure

- Hospital stay (typically 1-2 nights)

- Basic pre-operative testing

- Initial follow-up appointments

Self-pay packages typically range from $10,000 to $17,000, substantially less than the total billed to insurance companies.

Financing options

Medical credit cards: Companies like CareCredit and Alphaeon Credit specialize in healthcare financing, offering promotional interest-free periods (typically 6-24 months) for qualified applicants.

Personal loans: Traditional banks, credit unions, and online lenders offer personal loans that can be used for medical expenses. Interest rates generally range from a low of 6% for excellent credit up to a high of 36% for low credit scores.

Healthcare installment loans: Some lenders specialize in bariatric surgery financing, offering terms of 12-60 months.

Retirement account loans: Some patients borrow from their 401(k) or other retirement accounts, though this should be carefully considered due to potential tax implications and impact on retirement savings.

Payment plans: Many surgical centers offer in-house payment plans, allowing you to spread payments over 12-24 months, sometimes without interest.

Medical tourism options

Medical tourism—traveling to another country for surgical procedures—can significantly reduce costs. Popular destinations for gastric sleeve surgery include:

- Mexico: $5,000-$8,500

- Costa Rica: $8,000-$11,000

- Thailand: $8,500-$12,000

- Turkey: $6,000-$9,000

While these prices represent substantial savings, medical tourism carries additional considerations:

- Travel expenses and accommodations

- Potential language barriers

- Varying medical standards and accreditation

- Complications management after returning home

- Limited follow-up care

According to a 2024 study in the Journal of Obesity Surgery, approximately 1.8% of bariatric patients experience complications requiring additional interventions within the first 30 days following surgery, making access to qualified follow-up care essential.

Cost vs. value: The financial benefits of gastric sleeve

When evaluating the cost of gastric sleeve surgery, it’s important to consider the procedure as an investment in your health with potential long-term financial benefits.

Healthcare savings

Research from the New England Journal of Medicine shows that bariatric surgery can lead to significant reductions in healthcare costs over time. Patients often experience:

- Reduction or elimination of type 2 diabetes medications (saving $4,000-$7,000 annually)

- Decreased blood pressure medication needs

- Improved sleep apnea, potentially eliminating the need for CPAP therapy

- Fewer doctor visits and hospitalizations related to obesity

A comprehensive study published in JAMA Surgery found that bariatric surgery patients recoup their surgical costs through healthcare savings within 2-4 years on average.

Quality of life improvements

Beyond direct healthcare savings, patients often experience improvements that impact their financial well-being:

- Increased productivity at work

- Reduced absenteeism

- Greater mobility for daily activities

- Enhanced employment opportunities

- Reduced disability claims

According to employment data collected by the Obesity Action Coalition, bariatric surgery patients report a 47% reduction in work limitations and a 57% decrease in missed workdays after recovery, potentially translating to thousands of dollars in increased earnings.

Finding affordable gastric sleeve options

With some research and preparation, you can find more affordable options for your gastric sleeve surgery without compromising quality.

Researching providers

When searching for a bariatric surgeon or program:

- Check surgeon credentials and experience (look for board certification in bariatric surgery)

- Review facility accreditation (seek centers designated as Centers of Excellence by the American Society for Metabolic and Bariatric Surgery)

- Compare all-inclusive package prices rather than just the surgical fee

- Ask about revision policy and costs if complications occur

- Consider teaching hospitals, which sometimes offer reduced rates

Negotiating costs

Many patients don’t realize that medical costs are often negotiable:

- Request itemized quotes from multiple providers

- Ask about cash discounts (sometimes 10-20% lower)

- Inquire about financial hardship programs

- Negotiate payment terms directly with the hospital’s billing department

- Consider timing your surgery near year-end when providers might offer promotions to meet annual targets

Employer benefits to explore

Some employers offer benefits that can help with bariatric surgery costs:

- Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) allow you to pay for medical expenses with pre-tax dollars

- Some progressive employers offer supplemental bariatric surgery coverage

- Workplace wellness programs occasionally provide incentives or subsidies for weight loss solutions

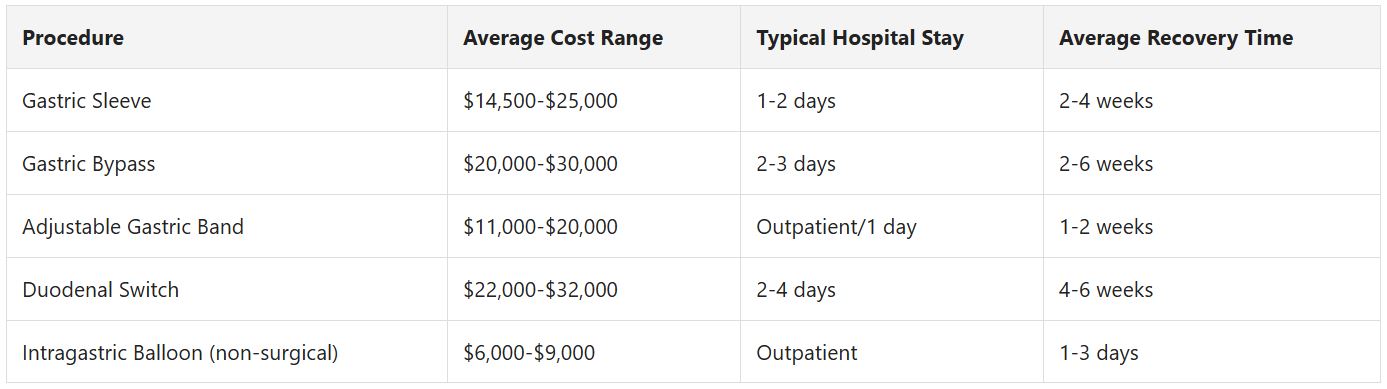

Gastric sleeve cost compared to other weight loss surgeries

Understanding how gastric sleeve costs compare to alternatives can help in making an informed decision.

Cost comparison chart

Long-term cost considerations

While initial costs are important, consider these long-term factors:

- Gastric sleeve: Generally requires fewer follow-up procedures than adjustable bands

- Gastric bypass: May lead to more vitamin deficiencies requiring supplementation

- Adjustable band: Requires regular adjustments and has higher reoperation rates

- Intragastric balloon: Temporary solution (typically 6 months) that may require additional weight loss interventions later

According to a 10-year follow-up study published in the Journal of the American Medical Association, gastric sleeve patients required fewer revision surgeries than gastric band patients (5.8% vs. 21.3%), potentially saving thousands in additional medical expenses.

Preparing financially for gastric sleeve surgery

Taking a systematic approach to financing your surgery can reduce stress and ensure you’re fully prepared.

Timeline for financial planning

Most patients benefit from a 6-12 month financial planning timeline:

12+ months before surgery:

- Check insurance coverage and requirements

- Begin documenting weight loss attempts if needed for insurance

- Start saving for out-of-pocket expenses

- Research surgeons and facilities

6-9 months before:

- Complete insurance pre-authorization process

- Apply for financing if needed

- Set up HSA/FSA contributions to maximize tax benefits

- Calculate time off work needed and budget accordingly

3 months before:

- Finalize payment arrangements

- Prepare for post-surgery expenses (special foods, supplements)

- Create a recovery budget (transportation to appointments, potential home care needs)

Building a surgery fund

Some practical approaches to building your surgery fund include:

- Setting up automatic transfers to a dedicated savings account

- Temporarily reducing retirement contributions (if necessary)

- Selling unused items

- Taking on temporary additional work

- Crowdfunding through platforms like GoFundMe (bariatric surgery campaigns raised an average of $5,800 in 2024)

- Asking family members for loans or gifts toward health improvement

Questions to ask about gastric sleeve costs

Before committing to surgery, ask potential providers these important questions:

- What’s included in your quoted price? (Pre-op testing? Follow-up visits? Nutritional support?)

- What complications are covered in the initial fee, and for how long?

- Do you offer a discount for self-pay patients?

- What financing options do you accept or recommend?

- How much should I budget for ongoing expenses like vitamins and supplements?

- What is your reoperation or revision rate, and what would those procedures cost?

- Do you offer payment plans, and if so, what are the terms?

- Are there additional costs for psychological evaluations or nutritional counseling?

- What insurance networks do you participate in?

- Can I get this in writing as a formal cost estimate?

Gastric sleeve surgery represents a significant financial investment, but one that many patients find worthwhile for the health improvements and quality of life benefits it provides. By thoroughly researching costs, understanding insurance coverage, and exploring financing options, you can make this potentially life-changing procedure more accessible.

Remember that while cost is an important consideration, the surgeon’s experience, the facility’s reputation, and the quality of the comprehensive bariatric program should be primary factors in your decision-making process. Quality care leads to better outcomes and potentially fewer complications, making it the wiser financial choice in the long run.

If you’re considering gastric sleeve surgery, start by consulting with your insurance provider and scheduling consultations with board-certified bariatric surgeons to discuss both your medical candidacy and financial options. Many bariatric programs offer free initial consultations where you can begin exploring the path that’s right for your health and financial situation.